How Much Fitra To Pay 2025 In Usa

BlogHow Much Fitra To Pay 2025 In Usa. Therefore, the dollar amount given is the estimated recommended equivalent value of 6.6 pounds of the basic food commodity. Fedyah (fidya) should ideally be disbursed before the fast it compensates for is due, and donations can be made conveniently online.

The amount for fedyah (fidya) in ramadan 2025 is $5 for each unobserved fast, which should be sufficient to offer two meals to one individual or one meal to two individuals. It is $10 per validly missed fasting day, at zakat foundation of america.

Fedyah (fidya) should ideally be disbursed before the fast it compensates for is due, and donations can be made conveniently online.

Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

The 2025/25 us tax calculator allow you to calculate and estimate your 2025/25 tax return, compare salary packages, review salary examples and review tax benefits/tax.

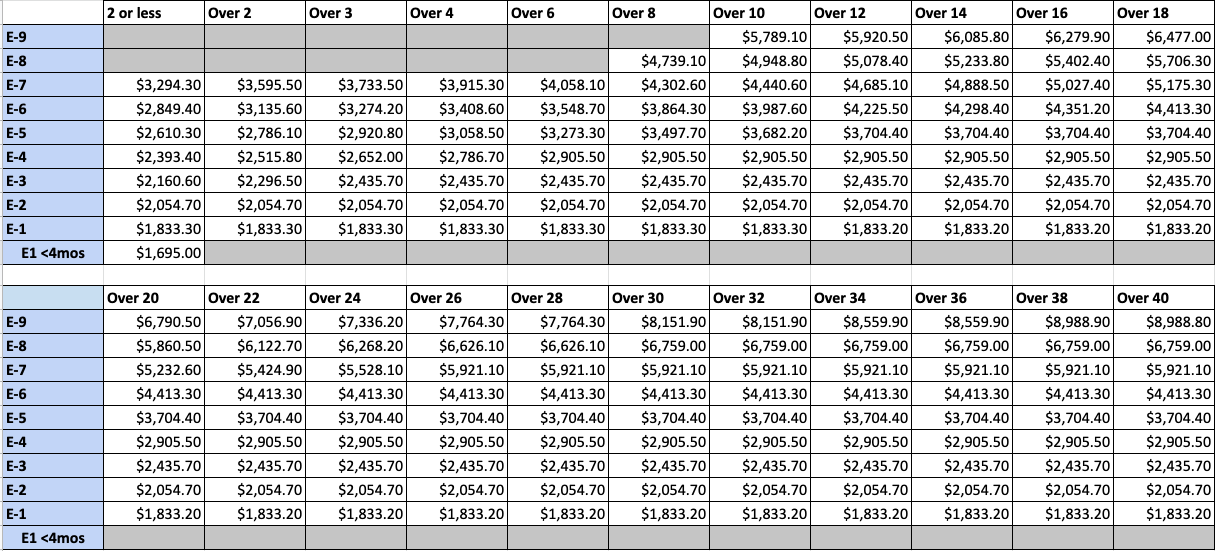

Proposed 2025 Military Pay Chart, The 2025/25 us tax calculator allow you to calculate and estimate your 2025/25 tax return, compare salary packages, review salary examples and review tax benefits/tax. It is advised that you consult with your local imam or scholar for more detailed.

2025 Federal Employee GS Raise and Salary Tables Latest News and, However, if someone misses all the fasts of. Kaffara ($600 per day) kaffara must be paid by one who misses or breaks the fast without any valid reason.

Maximize Your Paycheck Understanding FICA Tax in 2025, To calculate how much fidya you need to pay, multiply $10 by the number of fasts you have missed out of necessity. Therefore the quantity is described by prophet.

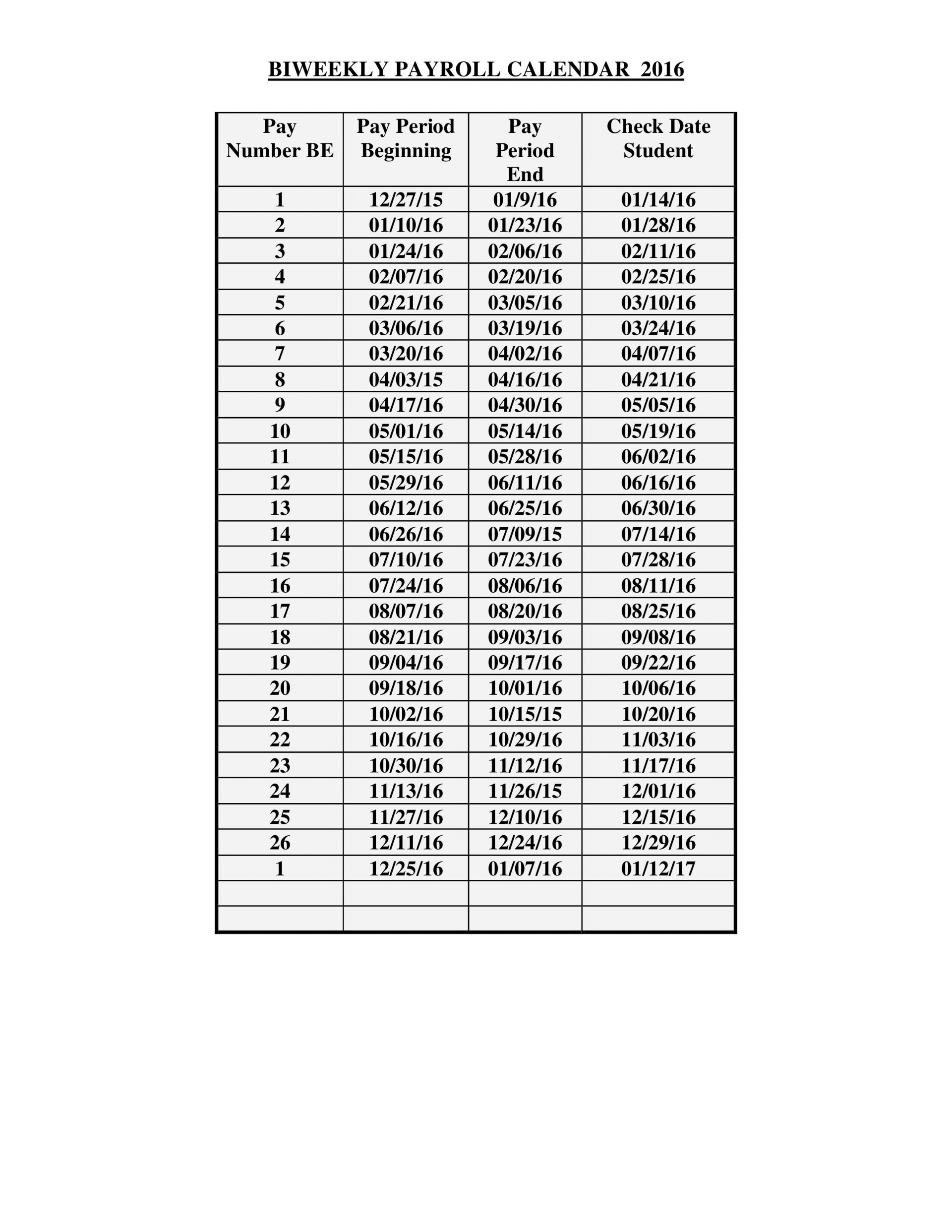

2025 Federal Pay Period Calendar, The amount that they must pay is a fixed amount (£5 in the. Fidya ($10 per day) fidya must be paid by one who is unable to fast due to illness or other valid excuses.

2025 Military Pay Raise Chart, The dollar is one of the world’s most stable currencies and is the only currency accepted in the us. At the time of the prophet (pbuh) fitrana (zakat ul fitr) would be given as one saa’.

Enlisted Pay Chart 2025, For a gross annual income of $72,020 , our us tax calculator projects a tax liability of $1,370 per month, approximately 23% of your paycheck. Fedyah (fidya) should ideally be disbursed before the fast it compensates for is due, and donations can be made conveniently online.

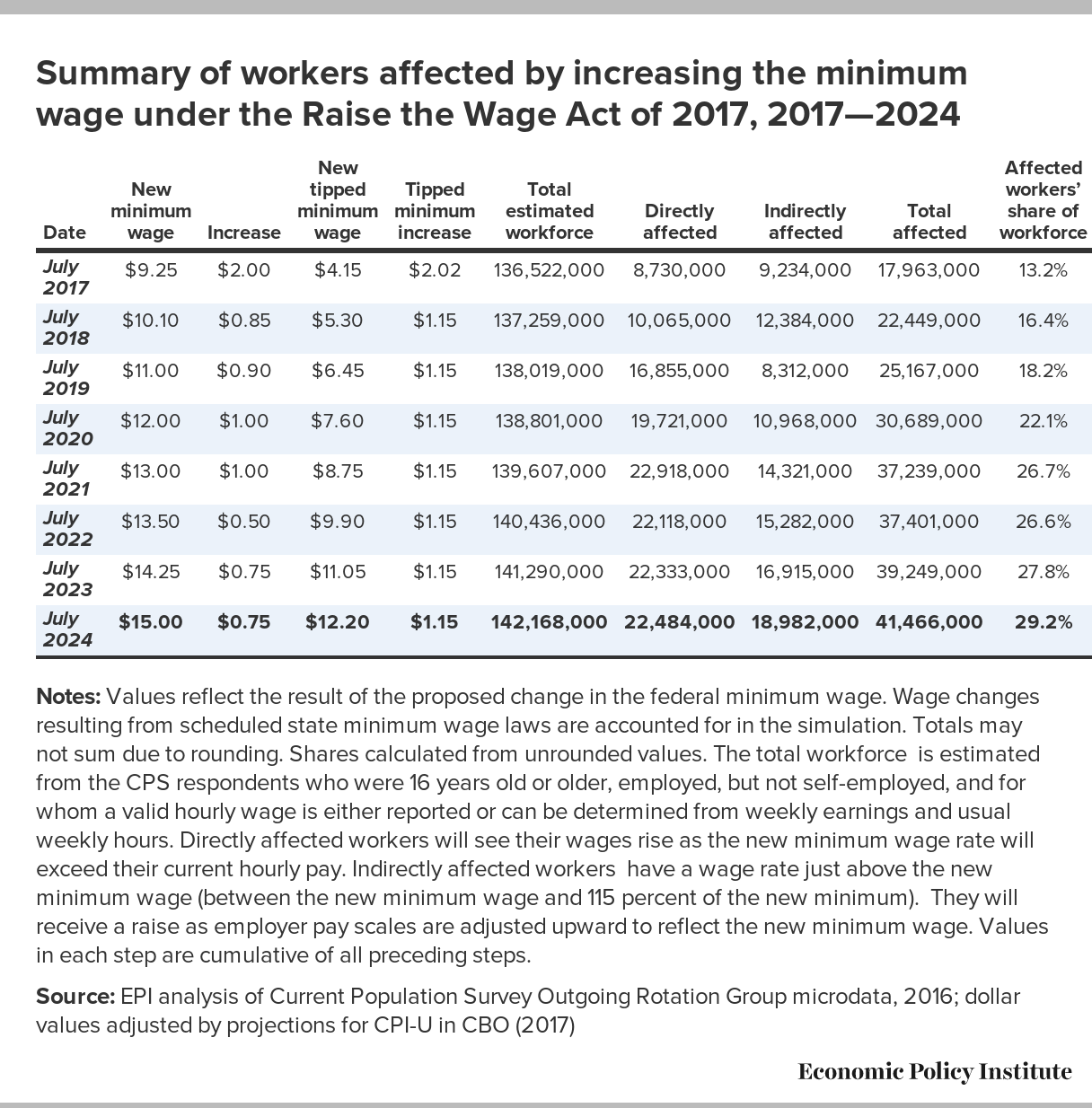

Raising the minimum wage to 15 by 2025 would lift wages for 41 million, In this article, all information is provided regarding the fidya. How much is fitrana (zakat ul fitr) per person?

Proposed 2025 Military Pay Chart Q2023H, The 2025/25 us tax calculator allow you to calculate and estimate your 2025/25 tax return, compare salary packages, review salary examples and review tax benefits/tax. Islamic relief usa consults with a zakat advisory board for information about religious donations.

2025 Biweekly Pay Calendar 2025 Calendar Printable, Therefore, the dollar amount given is the estimated recommended equivalent value of 6.6 pounds of the basic food commodity. On the day of eid, the zakat will be.

2025 Va Pay Chart, Fedyah (fidya) should ideally be disbursed before the fast it compensates for is due, and donations can be made conveniently online. One will have to pay a minimum amount of fitra set as per islamic rules.

Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

The total federal tax that you would pay is $5,978 (equal to your income tax, on top of your medicare and social security costs).

Ncaa Gymnastics Championship 2025. Bookmark this page for quick access. Check out how to watch […]

National Prevention Network Conference 2025. The national prevention network (npn) conference npnconference.org Home | the […]